The Autumn Budget 2024: A Comprehensive Analysis of Britain’s Path Amidst Fiscal Constraints

By Michelle Kazi

The Autumn Budget 2024, presented by Chancellor Rachel Reeves, lays out the new Labour Government's fiscal strategy amid a landscape marred by high debt and a sluggish economy that feels like it’s been stuck in neutral for far too long. In her approach, she aims to strike a delicate balance between the urgent needs of public services and the pursuit of sustainable growth, all while implementing a series of targeted tax increases. This isn’t just about numbers on a spreadsheet; it’s about rebuilding critical sectors like the NHS and investing in the future, all under the watchful eye of a high-tax, high-borrowing framework that promises to reshape the UK’s financial landscape for years to come.

This analysis delves into the budget’s key components, unpacking its implications for vital sectors including the creative industries, small and medium-sized enterprises (SMEs), and farming. As we navigate this complex fiscal terrain, it’s essential to understand not only the strategic decisions at play but also the real-world impact on the lives of people across the country.

Restoring Public Services with Record Investment

At the heart of this budget lies a promise to revitalise public services, a commitment that feels both urgent and necessary. A substantial 3.3% real-terms increase in departmental spending over the next two years is designed to shore up these vital areas. Health services, which have long been under pressure from extensive waiting lists and overstretched facilities, are set to receive a hefty £22 billion. This funding isn’t just a drop in the ocean; it’s geared towards establishing an impressive 40,000 extra weekly NHS appointments and expanding facilities with new surgical hubs and diagnostic centres—ambitious measures intended to reinvigorate an NHS that has been strained for years.

The education sector, too, isn’t left behind. The budget earmarks £4 billion for upgrading school infrastructure, promising much-needed renovations that could foster safer, more modern learning environments for our children. Notably, the UK's 2024 budget includes an additional £3 million to expand the Creative Careers Programme, aimed at helping schoolchildren explore opportunities in the creative sector. Moreover, commitments to further education are strengthened with an extra £300 million, while £40 million will transform the Apprenticeship Levy into a Growth and Skills Levy, making new apprenticeships more accessible. On top of this, research and development investment sees a significant boost, with £20.4 billion allocated for 2025-26, ensuring that at least £6.1 billion will cover core research initiatives vital for the country’s future.

By allocating substantial funding to health and education, the Chancellor seeks to tackle the deep-rooted structural issues that have plagued these essential services for far too long. However, it’s worth noting that these investments come with a caveat: all departments are tasked with meeting a mandatory 2% savings target. This dual focus on expanding public services while maintaining fiscal discipline is certainly a tightrope act. This austerity measure will undoubtedly test departmental efficiency and could strain services, especially if demand continues to soar or does not ease as anticipated.

This approach also rests on the assumption that this two-year injection of funding will lead to long-term stability for public services. Should spending pressures persist, the government may find itself facing hard choices—either raising taxes further or making cuts to unprotected services. This potential trade-off poses significant risks, as Britain’s public services may struggle to operate effectively under reduced budgets if demand keeps rising.

Economic Stability and Fiscal Prudence

The Autumn Budget introduces two new fiscal rules designed to anchor the UK’s economic strategy. The Stability Rule mandates that day-to-day expenses must be balanced by revenue, while the Investment Rule requires net financial debt to decrease as a proportion of GDP. These rules are aimed at establishing fiscal credibility by 2027-28, a timeline that highlights the government’s urgency in stabilising the nation’s finances amidst ongoing economic pressures.

Complementing these rules is a staggering £100 billion infrastructure fund, spread across five years—a term that conveniently aligns with a single government cycle. This fund is earmarked for developing essential infrastructure, including transport, healthcare, and education facilities. The considerable investment is intended to stimulate regional economies, generate jobs, and enhance long-term productivity across the UK. However, while the infrastructure plan signals a robust commitment to growth, it is heavily front-loaded, which raises serious questions about the feasibility and efficiency of such rapid spending. Past projects have illustrated that accelerated timelines can lead to inflated costs and mismanagement. This is a risk the government acknowledges and hopes to mitigate through oversight mechanisms within its “value for money” agenda.

Moreover, the heavy reliance on borrowing to finance these projects introduces additional layers of risk. Increased debt obligations may lead to higher interest costs, which could impact future budgets significantly. As it stands, the government’s success hinges on its ability to balance the immediate need for infrastructure improvements against the constraints of high public debt—an intricate balancing act that could shape the nation’s economic future for decades. However, uncertainties linger regarding whether these measures will genuinely foster growth. The Institute for Fiscal Studies (IFS) has pointed out that while the budget might provide a short-term boost, it could ultimately lead to subdued growth prospects as the country grapples with the implications of this heavy borrowing. This raises critical questions about the sustainability of such ambitious spending plans in an unpredictable economic climate.

Tax Policy: Fair Contributions Amid Economic Constraints

Tax adjustments play a pivotal role in the budget, with the government aiming to shield working individuals from any increases in income tax, VAT, or employee National Insurance contributions. However, the landscape shifts dramatically with substantial hikes in employer National Insurance Contributions (NICs) and Capital Gains Tax (CGT). Specifically, employer NICs are set to rise to 15% by 2025, coupled with a reduction in the secondary threshold to broaden the tax base. Meanwhile, the CGT rate is set to increase to 14%, designed to bring a fairer balance between capital gains and regular income within the tax system.

This strategy, while aimed at redistributing the tax burden more equitably, carries significant economic implications. The Office for Budget Responsibility has warned that the increase in NICs could suppress wage growth and curtail employment opportunities. Many employers might respond by shifting towards hiring self-employed contractors to sidestep the additional NIC costs. Similarly, the hike in CGT could dissuade small business owners from reinvesting in their operations, especially those who depend on asset disposals for capital. Such tax increases, despite their strategic placement, risk dampening the economic dynamism that the private sector so desperately needs to thrive.

This nuanced approach to taxation reflects the government’s balancing act between generating necessary revenue and maintaining economic stability. However, the stakes are high, particularly for SMEs, which form the backbone of the UK economy. The increased costs associated with higher NICs may lead these businesses to reconsider hiring plans or even scale back on staff, potentially stalling job creation in a sector that is crucial for innovation and growth. As the government navigates this complex terrain, it will be essential to ensure that these tax policies don’t inadvertently stifle the very sectors that are vital for Britain’s long-term economic health. The need for careful monitoring and adjustment will be paramount, as the success of this budget relies heavily on fostering a vibrant and resilient entrepreneurial environment.

Sector-Specific Implications: Creative Industries, SMEs, and Farmers

Creative Industries: Limited Funding for a Promised Pillar

Despite the government’s previous commitments to champion the creative industries as a driver of growth—central to their General Election pledges—funding for the Department for Culture, Media and Sport (DCMS) remains modest when compared to other departments. With an allocation of just £2.3 billion, the DCMS budget reflects limited increases, even as Labour positions the creative sector as one of eight critical pillars in its industrial strategy. While some funds are directed toward national museums and grassroots projects, this support is unlikely to catalyse transformative change across the broader sector, which encompasses vital areas like fashion, film, music, and design. In comparison, departments such as Health and Education have received significantly larger boosts, raising concerns about the government’s prioritisation of the creative economy.

The creative industries contribute substantially to both the economy and the UK's global reputation. The restrained allocation to DCMS could stifle growth in the sector, especially in international markets where competition is fierce. Many creative businesses, particularly smaller enterprises, may find themselves leaning heavily on private investment or forming partnerships to keep afloat. This limited funding raises pressing questions about the government's commitment to an industry it has consistently touted as vital to Britain's economic future.

Fashion Industry: Navigating Fiscal Pressures and the Lingering Impact of Brexit

The Autumn Budget 2024 offers scant direct support for Britain’s fashion industry, despite its significant economic contributions and role in enhancing the UK’s cultural standing on the world stage. With only modest funding directed at the creative sector overall, the fashion industry—a major pillar of this sector—receives no targeted relief. Smaller fashion brands, in particular, may feel the financial strain of navigating these choppy waters without the benefit of government-backed initiatives tailored to support their growth.

Brexit continues to loom large over the British fashion landscape, creating persistent hurdles like trade barriers, increased customs procedures, and higher import costs for brands reliant on European markets. The budget lacks provisions to mitigate these post-Brexit challenges, leaving fashion businesses grappling with substantial operational and logistical difficulties. Import costs have soared, and logistical delays are a headache, especially for smaller brands that often lack the resources to absorb these added expenses, in stark contrast to larger counterparts. With the absence of alternative trade deals, particularly with the US, the fashion industry’s international competitiveness is under threat, particularly in the EU, its largest and closest export market.

Compounding the challenges posed by Brexit, the hike in employer NICs adds to the labour costs, further stretching the already tight budgets of many fashion businesses. Previously, employers faced a rate of 13.8%, which is now set to rise to 15%. This increase means that for every £100,000 spent on salaries, businesses will need to budget an additional £1,500 just for NICs—an expense that could deter hiring and limit growth. As operational costs climb, many fashion companies will be forced to make tough decisions regarding pricing and workforce size. While the government’s broader investment in infrastructure might eventually offer indirect benefits to the industry, the immediate pressures of Brexit and rising expenses remain unaddressed, demanding extraordinary resilience from a sector that is crucial to both the UK’s economy and its cultural standing.

Small and Medium-Sized Enterprises (SMEs): Balancing Relief and New Pressures

For SMEs, the Autumn Budget presents a mix of relief and challenges. The expansion of the Employment Allowance serves as a helpful offset against the increased NICs, providing essential support to small businesses grappling with rising operational costs. Additionally, the freeze on the small business rates multiplier and targeted relief for retail, hospitality, and leisure sectors offer a lifeline to struggling high-street enterprises that have faced unprecedented pressures.

However, other tax measures could constrain SMEs’ growth potential. The phased increase in Capital Gains Tax (CGT) could discourage SME owners from reinvesting in their businesses. CGT is a tax levied on the profit from the sale of certain assets, and an increase means that when business owners decide to sell or dispose of their assets, they’ll face a heftier tax bill. This added financial burden can stymie growth and reduce available capital for reinvestment. The government’s efforts to raise revenue through employer taxes could inadvertently limit job creation, as the higher NICs might deter employers from hiring or expanding their workforce.

In an environment where Britain relies heavily on SMEs as a driving force of the economy, these constraints threaten to slow the recovery of a sector that is crucial for innovation and job creation. While immediate relief has been offered, the long-term fiscal landscape may prove less conducive to risk-taking or expansion. The government’s tax strategy must carefully consider the pressures SMEs face, as sustained constraints on small business growth could stifle broader economic resilience.

Farmers: Inheritance Tax Adjustments and Limited Pathways for Adaptation

The farming sector faces significant financial adjustments in this budget, particularly with changes to Agricultural Property Relief. By capping 100% inheritance tax relief to the first £1 million in agricultural assets, the government has increased tax obligations for family-owned farms. This adjustment could complicate estate planning and succession within the farming community, where multi-generational ownership is common. Many farms may struggle under this new tax burden, which could prompt consolidation within the sector as smaller estates face viability challenges.

Additionally, tax increases on energy costs will likely affect farmers reliant on machinery and transport, further increasing operational expenses in an already competitive market. While there is a growing emphasis on sustainable practices, the budget provides limited support for farmers to make this transition. Without sufficient incentives or subsidies, many within the farming sector may lack the resources to invest in sustainable methods, leaving them exposed to rising costs and regulatory pressures.

This budget’s approach suggests a hands-off stance on specific support for agriculture, placing the burden of adaptation on farmers. The broader risk is that without targeted assistance, the sector could see reduced resilience, impacting Britain’s food and fibre security and the economic viability of rural communities.

Conclusion: A Cautious Optimism Amidst Immediate Challenges

The Autumn Budget 2024 sets a difficult path for Britain, balancing investment in public services with selective austerity and high borrowing. It reflects a government committed to rebuilding essential infrastructure and improving healthcare and education, albeit within a constrained fiscal framework. Yet, the reliance on front-loaded spending, coupled with a long-term austerity vision, places pressure on the government’s ability to sustain these improvements beyond the initial years.

For the creative industries, SMEs, and farming communities, this budget presents a mixed outlook. While each sector benefits from some targeted relief, they face significant new challenges from tax adjustments and limited direct support. The budget’s success hinges on the assumption that the fiscal landscape will stabilise, allowing for sustained growth and future sectoral investment. If this stabilisation occurs, the government may eventually have the flexibility to bolster support for these industries. Until then, these sectors must navigate a taxing environment, marked by resilience and adaptability.

As Britain progresses through this transitional phase, the budget stands as both a promise and a gamble—a commitment to short-term improvement with the hope of long-term prosperity. Whether this strategy will achieve its intended goals remains uncertain, but it underscores the complex balance Britain must strike between austerity and ambition in a challenging economic landscape.

Podcast Episode: BBC Radio 4 Start The Week with designer Alice Robinson

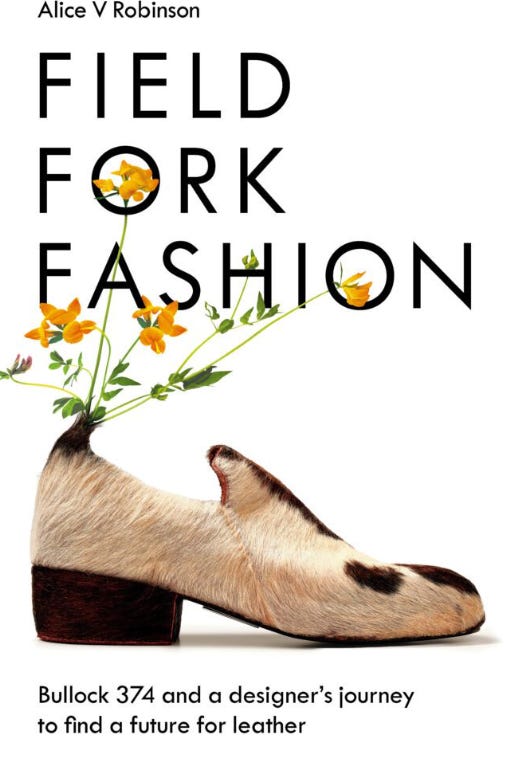

Alice Robinson, designer and Co-Founder of British Pasture Leather, has never shied away from the inescapable link between agriculture and luxury fashion. She joins Adam Rutherford on BBC Radio 4 Podcast Start The Week for a discussion on Ancient crafts: feathers, leather and thatch.

In her book Field, Fork, Fashion she looks back at the origins of her chosen material, leather, and traces the full life of Bullock 374 from farm to abattoir, tannery to cutting table. And in retelling this story she asks whether it’s possible to create a more transparent, traceable and sustainable system

Online Event: Design For The Planet Festival, TOMORROW 6th November 2024

Don't miss the sustainable design event of the year!

Join the fourth edition of Design for Planet Festival, a virtual event on Wednesday 6th November, to discover how to design for Planet Positive Business.

Hear from an incredible line up of design, business and government leaders on how the power of design can be used to achieve both economic and environmental success